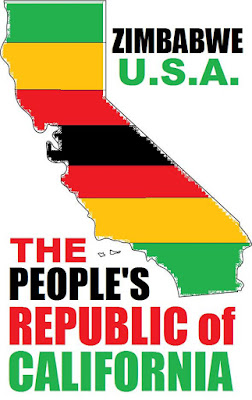

Amazon Goes Galt, Cuts Off California to Avoid Internet Tax in Zimbabwe, U.S.A.

Posted on | June 30, 2011 | 38 Comments

It was in February 2009 that I first compared the situation in California to Mugabe’s bankrupt kleptocracy. And the situation is only getting worse:

It was in February 2009 that I first compared the situation in California to Mugabe’s bankrupt kleptocracy. And the situation is only getting worse:

Gov. Jerry Brown has signed into law California’s tax on Internet sales through affiliate advertising which will immediately cut small-business website revenue 20% to 30%, experts say.

The bill, AB 28X, takes effect immediately. The state Board of Equalization says the tax will raise $200 million a year, but critics claim it will raise nothing because online retailers will end their affiliate programs rather than collect the tax.

Amazon has already emailed its termination of its affiliate advertising program with 25,000 websites.

In essence, Amazon has “gone Galt” rather than submit to California’s Internet tax. The immediate victims? California bloggers like Donald Douglas at American Power.

For the benefit of anyone too stupid to understand why the California Internet tax is a bad idea: All the revenue from sales commissions to California’s 25,000 Web site operators who had participated in the Amazon Associates program was taxable as income.

Now? Zero income. And also zero sales.

Ergo, nothing to tax.

It is astonishing to see how California, where venture capitalists once made Silicon Valley the world capital of technological innovation, has now turned anti-capitalism, anti-technology and anti-innovation, driving the world’s largest Internet retailer out of America’s most populous state.