What I Would Argue Is That This Shows the Federal Reserve as Antithetical to the Constitution

Posted on | April 21, 2011 | 5 Comments

by Smitty

Senator Sanders (D-upe) underscores that from the mouth of bozos truth occasionally escapes:

“You can argue that the chairman of the Fed is more important than the president of the United States, but very few Americans understand what the Fed does,” says Sen. Bernie Sanders, a Vermont independent who successfully pushed for the Fed to disclose more about its secretive bank lending. Addressing the press, Mr. Sanders says, will be “a step forward.”

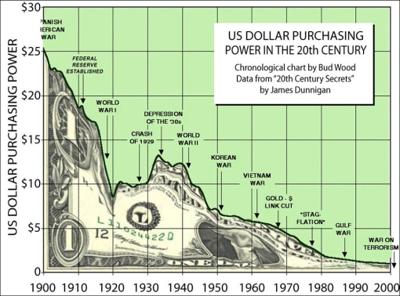

Here, in a graph, is what the Federal Reserve does, Senator Sanders:

As the economy continues its slow-motion capsize, keep in mind that the centennial of the Federal Reserve is coming the year after next. Can we bring about its demise? Why yes: yes, we can. Thomas Sowell on the Fed:

When someone removes a cancer, what do you replace it with?

Via GaltsGirl on Twitter, here is some intriguing Fed news:

In terms of the larger trends, the fundamentals that have caused so much pain and economic woe over the last ten years or so remain intact. If anything, they’ve gotten worse. We’ve gotten currency debasement, not just in the U.S., but especially in the U.S. dollar, which is not just any currency, but the world’s reserve currency.

We’ve got a truly mind-boggling expansion of the reach of government into all aspects of society and the economy, with all that that implies in terms of regulation, taxation, controls over investments and finance, impact on personal liberty, and so forth. By recognizing this destructive trend for what it is, investors can position themselves to avoid the worst, and to profit by betting on things like the continuing debasement of the dollar.

So that’s the big picture.

There is growing evidence that in the next month or two, we will head into a very dangerous period. The Fed has been extremely supportive of the U.S. government’s insane spending, polluting its own balance sheet by buying up toxic loans by the hundreds of billions and by pumping enormous quantities of cash into the money supply.

You don’t have to look very hard to understand why we have seen some small recovery in the economy, much of which has been driven by the financial sector that has been the recipient of so much largess – it was bought and paid for by the government, working hand in glove with the Fed.

But there is about to be a fundamental change in this arrangement. It appears that the Fed has decided that it’s time to take a step back from its monetization – or quantitative easing (QE), as they now term it – in the hopes that the market will step in to fill the large gap it will leave.

Unfortunately, there is going to be massive pressure to do whatever it takes to support the reality show Obama II: It Just Gets Creepier.