Has Alex Knapp Proven Anything?

Posted on | February 20, 2011 | 7 Comments

“Contrary to my colleague Doug’s description of the Federal government as existing primarily to redistribute wealth, there is actually very little wealth re-distribution in the United States.”

— Alex Knapp, Outside the Beltway

It is not my habit to defend Doug Mataconis, as he and I very often disagree about politics. But Doug’s post, “The U.S. Government Exists Primarily To Write Checks And Redistribute Wealth,” based on an analysis of Office of Management and Budget data by John Merline, was perfectly reasonable. And so the response by his Outside the Beltway colleague Alex Knapp drew my attention.

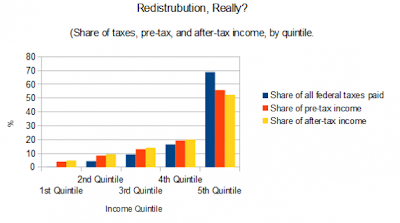

Knapp employs a chart based on numbers from the Congressional Budget Office:

What this shows is that the fifth quintile (top 20%) of income-earners pay nearly 70% of federal taxes, while earning about 55% of all pre-tax income. Because they also earn about 51% of after-tax income — a relatively small differential between their pre- and post-tax incomes — Knapp says, “See? No redistribution!”

Knapp’s rather limited “proof,” however, overlooks many possible objections. What is a minor cost to a wealthy person, for example, may be a bonanza for a poor person. Bill Gates’s fortune has been recently estimated at $54 billion. If I could get my hands on just one-tenth of one percent of that sum, I’d be a multimillionaire.

Thus, the 4 percent net loss of income share experienced by the top quintile (as estimated by the CBO) due to federal taxation may seem a minor redistribution to them, or to Knapp, and yet it would be a substantial gift if it were lavished directly on those in the bottom quintile — but it most certainly is not.

Rather, as Merline explains, of the payments to individuals — 66 percent of federal expenditures in fiscal year 2010 — “More than half goes to seniors through Social Security and Medicare. Only about 38 percent goes to the poor.”

The biggest redistribution that is occurring, you see, is not necessarily from the rich to the poor, but rather from the young to the old. Many of the retired senior citizens receiving federal payments are much more prosperous than the working young people whose taxes pay for those checks. This is not surprising, given that the elderly have had a lifetime to accumulate net worth — including investments which continue to provide income after they are retired — while those ages 18-30 are often substantially in debt, either for student loans, for mortgages, car loans, or consumer credit.

Yet these transfer payments for the benefit of retirees are not the only way the federal government redistributes income. It also does so geographically, with some states seeing a net gain via the federal government and others seeing a net loss.

Based on 2005 data, the top five states in terms of federal expenditures received per federal tax dollar (i.e., the top net gainers) are New Mexico, Mississippi, Alaska, Louisiana and West Virginia. The five states that pay the most in federal taxes per dollar of federal expenditures received (i.e., the top net losers) are New Jersey, Nevada, Connecticut, New Hampshire and Minnesota. (Caveat: This data was actually compiled by a liberal, seeking to show that GOP-leaning “Red” states were on the mooch.)

Why should taxpayers in Connecticut be footing the bill for folks in Louisiana? Or why should the federal government pick the pockets of Nevadans in order to support neighboring New Mexico? And we shouldn’t be surprised to learn that the two states bordering Washington, D.C. — Maryland and Virginia — are both gainers in the process, ranking No. 33 and No. 41 in the net-gain-from-federal-revenue calculus.

The relative wealth of the D.C. suburbs (Loudon County, Va., is America’s richest county, Fairfax County, Va., is No. 2 and Howard County, Md., No. 3) points out what I consider the most genuinely pernicious aspect of federal redistribution: Namely, its incentive to individuals to orient their economic activity toward the policies of the federal government.

When you look at the affluence of the D.C. suburbs, you see the most obvious consequence of the growth of the federal Leviathan, which lavishly rewards people who have planned their careers based on the question, “How can I make a buck off Washington?” To re-phrase the formula, there is now a huge economic incentive for ambitious people to look at the federal government and ask, “What’s in it for me?”

The winners in such a game may, in a general sense, be good people pursuing worthy aims. I do not automatically assume, for example, that a highly-compensated lobbyist for a defense contractor is engaged in nefarious activity. And I’m sure that there are many good hard-working people employed by the federal Department of Education, which I would abolish altogether, were it in my power to do so.

What I am stipulating here is that we need not pass moral judgment on the people who get rich sucking the federal teat in order to oppose the enormous expansion of the government sow that feeds them.

Rather than any moral condemnation of the individuals — whether Social Security recipients, single mothers on food stamps or political appointees at the State Department — who are net gainers in the federal government’s redistributionist activities, what I oppose is the cumulative drain on the private sector, which is the sole ultimate source of all this money. And I further condemn the artificial and political distortion of economic incentives, that encourages people to engage in activity subsidized (directly or indirectly) by government policy, to the detriment of activities that the non-politicized free market demands.

Were I asked to summarize my thesis here, I think the following sentence would be just about right:

The federal government is too damned big and

too damned expensive, and it’s fucking up our economy.

Certainly I am not alone in this belief, and my objection is nothing new. From its inception, the federal government has been criticized as too powerful. When students read the Federalist Papers, they ought to be informed — as I fear they seldom are — that Madison, Hamilton and Jay were answering specific criticisms of the newly wrought Constitution, criticisms made by those who opposed ratification. Among the Anti-Federalists were such eminences as Patrick Henry and George Mason, and every time you see Madison & Co. denying that the federal government would be a threat to the life, liberty and property of Americans, those denials ought to be considered in light of the accusations made by the Anti-Federalists. But I digress . . .

Protests against the federal government as an engine of economic redistribution are, as I say, nothing new. That this redistribution introduces an extremely divisive factor into our political life can be illustrated by the following quote:

The necessary result, then, of the unequal fiscal action of the government is, to divide the community into two great classes; one consisting of those who, in reality, pay the taxes, and, of course, bear exclusively the burthen of supporting the government; and the other, of those who are the recipients of their proceeds, through disbursements, and who are, in fact, supported by the government; or, in fewer words, to divide it into taxpayers and tax-consumers. . . .

[T]he greater the taxes and disbursements, the greater the gain of the one and the loss of the other — and vice versa; and consequently, the more the policy of the government is calculated to increase taxes and disbursements, the more it will be favored by the one and opposed by the other.

The quote is from an essay entitled, “A Disquistion on Government,” the author of which was John C. Calhoun.

It was Calhoun’s belief that the stormy sectional conflicts of his era — he wrote the Disquistion between 1843 and 1848 — were essentially a struggle between economic interests, each seeking to control the federal government for their own benefit. And we may assume from his argument and from his historical reputation that Calhoun believed the North was trying to use the federal government’s “unequal fiscal action” to enrich itself at the expense of the South.

Students of 19th-century history may decide for themselves whether Calhoun’s suspicion was well-founded or not. My point is that more than 150 years ago, at a time when the federal government was much smaller and less burdensome than it is now, the dispute over its role was sufficiently divisive to bring about a civil war a decade after Calhoun’s death in 1850.

Should we therefore be surprised at the “vitriol” and incivility of politics today? Certainly not, if we understand that the struggle over control of the federal government involves matters of economic self-interest, and that the ability of the federal government to help or hinder such interests is so much greater than it was 150 years ago.

That we do not today have a regional issue like chattel slavery to be used as a political cudgel in these arguments prevents the dispute over the “unequal fiscal action” from resulting in secession or armed strife. But the absence of that kind of conflict does not eliminate the real harm done by the federal government in terms of the perverse incentives it fosters in our economic life.

Big government is both a political and economic evil and, I would argue, a moral evil as well.

This is because as government grows in its size and influence, citizens are encouraged more and more to abdicate responsibility for their own lives, and to look to government to solve their problems, to provide them with income and security and even a sense of self-esteem.

An increasingly powerful government provides the disgruntled failure with a handy scapegoat for his shortcomings, a political excuse for whatever gap exists between his actual circumstances and his aspirations. When Peggy Joseph declared her belief that Obama’s election would relieve her of the need to pay her mortgage and put gas in her car — “If I help him, he’s gonna help me” — she was expressing this fundamentally immoral attitude.

Did the expression of that attitude make Peggy Joseph an especially bad person? I don’t think so. Rather, she was merely expressing in unusually explicit terms a belief held by many millions of Americans, a belief that the relentless expansion of government has fostered: That our economic well-being is a direct function of who controls the “unequal fiscal action” of the federal government, and that the key to our individual success is to elect those who will reciprocate our political support with economic largesse.

To adapt a remark I made many years ago, “What part of ‘Thou shalt not steal’ is so hard to understand?”

If you are using the power of government to extract unearned wealth from somebody else’s pockets, you are engaged in theft, no matter what you call it. And your hypocrisy, in claiming that such theft is actually a pursuit of your “rights,” only worsens your sin.

At least the robber who points a pistol and says, “Stick ’em up!” doesn’t pretend to be engaged in social justice.

Yet it isn’t just Peggy the Moocher who sinfully seeks her self-interest through the immoral power of government. If it is true, as we are told, that the rich are getting richer, we have to ask whether this is because many of these rich people have figured out how to use to their advantage the economic power of big government. When we see people getting rich (or rather, getting richer) on Wall Street after a series of federal bailouts, certainly we ought to ask how much of that new-gotten wealth was honestly earned.

Only if we view the world through the distorted prism of class warfare, however, does it matter whether the rich or poor benefit most from the “unequal fiscal action” of the federal government. If I pay $100 in federal taxes and get $101 in federal benefits, my one dollar of net gain is just as dishonest as the million dollars gotten by the man who pays $10 million in taxes and reaps $11 million in return.

So as to the dispute between Doug Mataconis and Alex Knapp, I come down forthrightly in favor of Mataconis. The federal government is certainly engaged in redistribution, and the only way to ameliorate that evil is to shrink the federal government.

* * * * *

Having spent about three hours composing an argument of nearly 2,000 words, my advocacy of the free market requires me to be content leaving readers to decide the value of my work. If what I’ve written is worth a penny a word, that’s $20. If my time is worth $10 an hour, that’s $30.

Readers may hit the tip jar for whatever amount they consider fair, but if experience is any guide, most readers consider my words worth absolutely nothing. So either I’m wasting my time, or else the majority of my readers are moochers. Neither supposition is reassuring, considering that Arianna Huffington recently cashed in to the tune of $18 million.

Surely you think I’m worth more than Arianna, right? So if you hit the tip jar for a mere $18, at least I’ll know I’m doing something worthwhile.

Otherwise, I suppose I’ll have to learn to talk lahk zeez, dahlink!